MPHASIS WYNSURE BILLING PLATFORM

Smart Billing for Group and Individual Insurance

• Secure • Modular • Scalable • AI-enabled • Integration-Ready

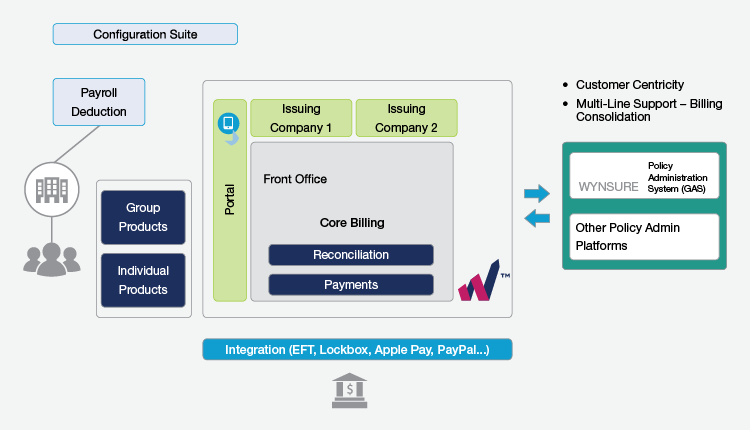

Mphasis Wynsure Billing Platform (MWBP) is a comprehensive billing solution for insurance carriers, brokers, and billing service providers who aim to achieve operational excellence and a differentiated customer experience. Through automated workflows, MWBP streamlines billing and reconciliation across all group benefits and individual product lines and seamlessly integrates all participants across the insurance value chain—from employers and their employees to brokers, carriers, and their affinity partners. MWBP offers a subscription fee option, significantly reducing initial investment costs and accelerating your digital transformation journey.

Mphasis Wynsure Billing Platform covers every step from billing to reconciliation & accounting, significantly reducing operational costs and errors, streamlining cash flow, plugging revenue leaks and enhancing customer satisfaction.

Premium & Remittance Interface Hub

Billing & Payroll Deductions

Payments & Reconciliation

Commissions & Disbursements

Data & Analytics

Group / Member Billing Portal

Customer Experience

Ops Excellence

Business Growth